|

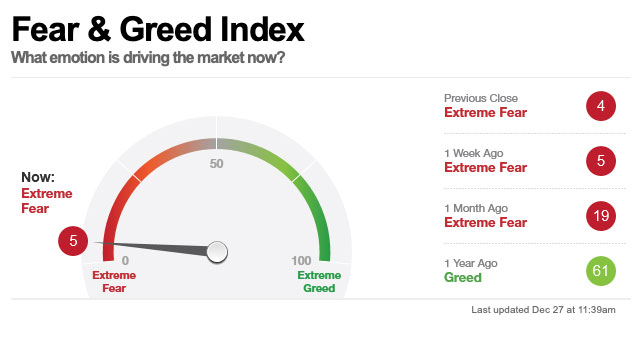

Are we merely in a correction or are we headed into full bear territory? Time will tell the extent of the market downturn, but what remains clear is a correction seemed inevitable in 2018. Over the course of this past year, we have seen a significant shift in the emotions driving investors from greed to extreme fear, further fueling recent volatility. After a prolonged and historic bull run in 2017, the equity markets stagnated in 2018 and dipped close to correction territory on numerous occasions before finally tanking during the holiday season, triggering the stop-loss mechanism in Beacon’s Vantage portfolios on December 21.

Source: CNN Business Source: CNN Business

MECHANICAL STOP-LOSS AND BUYBACK

As emotions of either extreme lead investors to act against their best intentions, at Beacon, we believe in eliminating emotion from investing altogether. Our front-line defense for dealing with uncertainty is by following a set of predetermined rules with mechanical precision. Even with the stop-loss triggered, this is a great opportunity to provide value and education to your clients and prospects emphasizing that the timing for both exiting and buying back into the market are of equal importance and are fully automated with our signature Vantage portfolios.

FEEDBACK FROM THE FIELD

Since triggering the stop-loss, our advisors have shared three key reasons they’re happy (and relieved) to have assets on the sidelines for the time being:

Geopolitical turmoil. Whether our domestic policies, international trade policies or international events, there’s been an expressed overwhelming feeling of uncertainty about how these issues will be resolved. As one advisor explained, “It doesn’t matter whether it’s China or Russia or something going on in the Middle East, I’m just happy my clients are out of the market right now.”

Eliminate emotional decision-making. Our advisors said they understand, now more than ever, that emotional investing is what gets investors in trouble. “Euphoric emotions have us putting bets where we shouldn’t be putting bets,” one advisor said. “And depressed emotions have us saying we don’t ever want to be in the market again.”

The mathematical consequences of losses. Finally, advisors are saying they understand that losses have a greater impact on a portfolio than gains do. As one advisor told us, “I was just telling one of my clients that a 10% gain is not equivalent to a 10% loss. If you have a minus 10, you will need a plus 11 just to get back to even.”

THE BOTTOM LINE

More than just returns, we are focused on outcomes—primarily the outcome of providing a smoother ride and reducing the extremes that can derail a portfolio in times of volatility, particularly at or near retirement.

As you have conversations with clients about market uncertainty and the strength of stop-loss investment strategies, we encourage you to utilize the client education tools available to you on the Advisor Toolbox, which are designed to help you educate and grow trust with your most valued clients, particularly in these times of volatility. For additional information on how you can educate clients on the dangers of emotional investing and the power of stop-losses, contact your wholesaler today!

|