|

As we continue in the longest-running bull market since World War II, headlines consisting of everything from interest rate movements and foreign policy to political Twitter activity have a jarring impact on our daily markets. So much so, earlier this month JP Morgan even released an index to track the impact of a Presidential Tweet for US Treasury bonds.

At Beacon, our position remains clear: volatility is the new normal. The S&P 500 has declined by more than 2% in one day 212 times between 2000 and 2018, compared to 160 times in the preceding 50 years. Our goal is not to beat or even to keep up with the S&P 500, but rather to help provide consistent returns and protection from losses before they become catastrophic.

Vantage 2.0 is not the S&P 500

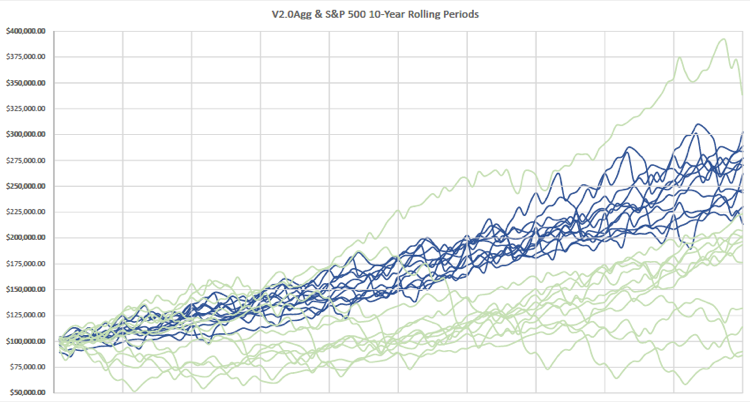

In looking at a rolling period of 10-year returns starting in 2000 to 2019, the green lines below show the extreme range the Vanguard 500 Index Fund (VFINX) has produced, with the top trending line being present day. The blue lines show the same rolling 10-year periods for the Vantage 2.0 Aggressive Portfolio, falling exactly where we’d expect them to be—consistently in the middle, removing the extreme ups and downs.

A Better Benchmark: 60/40 Balanced

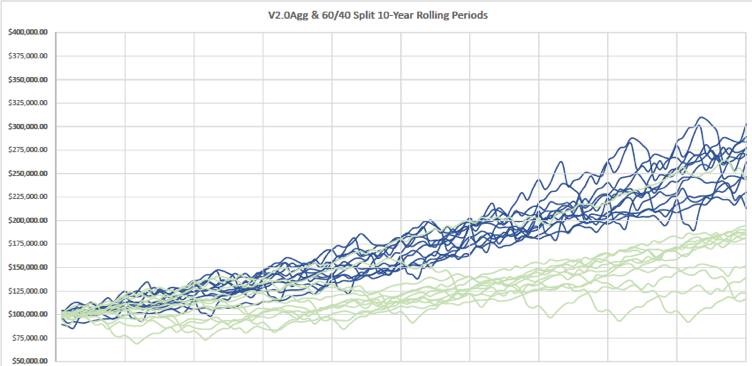

By comparison, when using a more appropriate benchmark of a balanced portfolio with a 60/40* split, the Vantage 2.0 Aggressive has consistently outperformed during the same period.

*60/40 Balanced model is represented by using weights of 60% allocated to the Vanguard 500 Index Fund (VFINX) and 40% allocated to the Vanguard Total Bond Market Index Fund (VBMFX)

Providing Education & Setting Expectations

In a recent newsletter issue, we shared the importance of moving from an “advice-first” to and “education-first” practice. Understanding and clearly communicating the goals of an investment portfolio are paramount to a successful, advisor-client relationship. This is particularly true now with markets that have investors’ emotions running high and the memories of 2008 more than a decade in the rearview mirror, seemingly forgotten by many clients, and even some advisors.

While participation in market upsides is important for long-term success, the pursuit of homerun performance should not distract clients from their financial planning goals. Investors need to be reminded of the devastating impact a correction can have on their investments. It is not a matter of if the markets correct, but when and by how much. Can your clients afford to take that hit? Would the extra few percentage points of gains today drastically change their life? Probably not. Would a double-digit loss delay or derail their life dreams? Possibly. It’s important to direct clients’ focus on what really matters to their plans.

Now Available: Client Volatility Presentation

We have recently released a client-approved presentation of our “Volatility” presentation available on our website. In this educational tool, we share an impactful sequence of returns scenario, the statistics of losses being more powerful than gains and key fundamentals of emotional investing. We hope you will use this new resource as a tool with your clients and prospects.

For more information about Beacon portfolios or the many educational resources we have available for you and your clients, contact your wholesaler today!

|