|

December 2018 was a volatile month. The wild market swings had investors antsy. At Beacon, we heard the panic from them: “Is this 2008 again?” “Are we going into a recession?” “Are the relations with China going to blow up?” “What’s going to happen with the government shutdown?” People were really getting spooked, and for good reason, because the markets were taking a beating. The only question was how bad it would be.

Finally, the market hit the stop-loss triggers we had in place, and we sold out on December 17. We placed the assets in conservative investments, all fixed income, and we watched the market drop for another week until it had its full flush out on Christmas Eve. And we weren’t alone in getting out. According to Morningstar, actively managed mutual funds experienced nearly $143 billion in outflows in their worst month on record.

A Smoother Ride

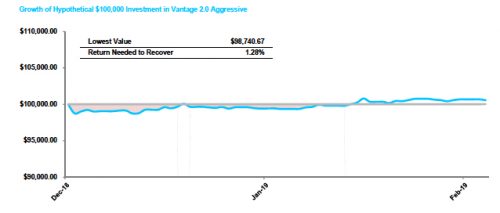

After we sold in December, the market dipped another 9.5 percent. If we use the hypothetical of a $100,000 investment in Vantage 2.0 Aggressive, the investment dropped to $98,740 and needed 1.28 percent to recover.

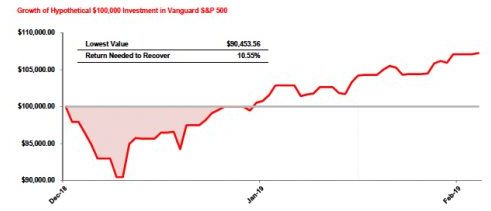

This compares to a $100,000 investment in Vanguard S&P 500, which hit a low of $90,453, requiring 10.55 percent needed to recover. This compares to a $100,000 investment in Vanguard S&P 500, which hit a low of $90,453, requiring 10.55 percent needed to recover.

In all, we saved clients roughly 9.5 percent during the volatile month of December. We also helped saved them peace of mind.

Better Safe than Sorry

As it turned out, the December swoon turned out to be something of a false alarm. Instead of continuing to drop, the equities rebounded. And the markets received additional positive news as The Fed changed their stance on interest rates, helping with the quick recovery to the market.

Because we’re located in the Midwest, we often use the analogy of tornado alarms when describing our investment philosophy. When the tornado alarms go off, you go hunker down. You head to your basement and you wait. Most of the time, it turns out to be nothing. But if it turns out to be something, and your house is obliterated, you’re happy you listened to the warning signs and got to a place of safety.

The same can be said for our investment philosophy at Beacon—we’d rather be safe than sorry. Based on our research with our clients, they’re okay with not making everything the S&P 500 is because protection from losses is more important to them.

If you would like to learn more in-depth tools and strategies on how to communicate the Beacon philosophy of delivering more predictable outcomes to your clients, contact your wholesaler today!

*This information is a representation of how the model portfolio performed during the most recent Vantage 2.0 stop loss cycle. A stop-loss cycle is measured from the time equity positions were sold for fixed income until the time equities were repurchased. Please download Stop-Loss Analyzed for full disclosures.

|